Properly estimating the baseline cost of a retirement lifestyle and how to fund it is vital to success, however; the work does not stop here. To do this thoroughly, one needs to prepare for the inevitability of something going wrong. The common concerns for retirees come in the form of spending shocks like long-term care, or unexpected healthcare costs. They are generally understood, but there are additional factors under the surface that are exacerbating their effects, which makes precise planning critical. As retiree life expectancy continues to increase, the probability of occurrence increases, and the effect on your finances worsens. These shocks may pose greater risks to you than previously thought. They can’t be completely avoided, but understanding your exposure, the potential costs, and how to mitigate them will provide more precise estimations, and by extension, improve your chances of a successful retirement.

What does the data say?

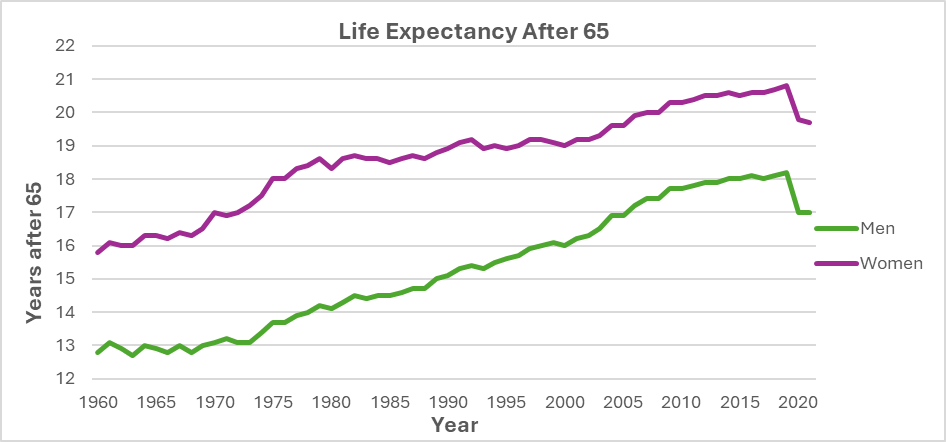

To understand how spending shocks are changing, we need to understand life expectancy trends. Over the past few decades, life expectancy after 65 has consistently increased, and will most likely continue to do so.[1] A longer life expectancy is great, but as it increases, so does the chance that a retiree will outlive their assets. This is what’s known as longevity risk.

The obvious solution would just be to plan for a few more years, right? Unfortunately, it’s not that simple. When you dive into the actuarial data, the timeline increases even more. For a retired couple in good health, there is a 90% chance that one survives to 85, and a 50% chance one lives to 94.[2] To truly be longevity risk averse, planning for one person in a couple to live until 95 is the minimum starting point. This increases a retirement period to ~30 years, which introduces the perfect storm of greater longevity risk, compounded inflation, and exposure to spending shocks at the most vulnerable point of retirement. All of which need to be properly accounted for.

Inflation has always been prevalent, but its degree of harm increases as retirees live longer. Similarly to the way an investment compounds, inflation erodes purchasing power through discounting. This is what the present value of $1,000,000 at a 2% inflation rate (without growth or taxes) will be worth at different points throughout a 30-year retirement period:

| Year: | Present Value: |

| 1 | $980,392 |

| 5 | $905,730 |

| 10 | $820,348 |

| 15 | $743,014 |

| 20 | $672,971 |

| 25 | $609,530 |

| 30 | $552,070 |

As the retirement period lengthens, the loss of purchasing power snowballs, which exacerbates longevity risk when trying to maintain standards of living. A dedicated growth portion of a portfolio is critical. Especially when healthcare and long-term care costs are considered as their inflation trajectories are higher than that of general goods and services.

Health Induced Shocks

With a retiring population that has increasing life expectancies, a greater number of people will have health issues during their advanced years. According to the Boston College Center for Retirement Research, 80% of today’s 65-year-olds will need 1 to 3 years of long-term care in some form.[3] The price varies by state and severity of health impairment, but today’s costs for Grand Rapids typically range between $20,000 and $100,000 yearly.[4] Given current trends, costs are inflating by 3-5% annually, so by the time these services are needed, they may be much more expensive. Risk transfer tools like long-term care insurance or hybrid (life insurance with long-term care riders) policies are an effective planning option but are expensive. Like standard life insurance, there are underwriting procedures that determine your risk category. Factors like age, health, and family history are considered when determining premiums/coverage. Unfortunately, if planning is delayed until well into your 60’s, premiums are typically too high. At this point, the only option is to self-fund with retirement savings or Health Savings Accounts as Medicare does not help.

Considerations around spending shocks are not limited to preparation for long-term care. Medical care is one of the biggest costs retirees are faced with. According to the Employee Benefit Research Institute (EBRI): Couples enrolled in Medicare with a supplemental Medigap plan with average premiums will need $351,000 to have a 90% chance of covering medical expenses. In extreme cases with high drug costs, a couple could spend as much as $413,000 post-retirement.[5] This number is not static either. From 2023 to 2024 Medicare Part B premiums increased from $164.90 to $174.70, which is a 5.9% increase. During unexpected periods of high inflation, costs ramp up quickly. Especially when compounded over a full 30-year period. Due to how widely Medicare options vary, a general estimate of the costs gets difficult, but factoring in family history, inflation rates, and the plan that suits you is a good starting point. From here conservative estimates can be made to limit underfunding.

Spending shocks cannot be completely avoided. They may be on your radar in a general sense, but understanding how they interrelate and are changing is vital. Precise estimates of their costs and your risk exposure will help in creating a longevity risk-averse plan that is thorough. Putting in the time now to understand this may affirm that you’re on track or need to adjust. If an adjustment is needed, you can estimate to what degree. As the last article mentioned, discretionary retirement spending generally decreases as a person ages. If you pair this with a dedicated growth portion of your portfolio, a risk transfer technique, and sound planning you can decrease the risk these shocks pose to you, your goals, or family. There are a multitude of strategies to lessen their impact, so lean on Legacy Trust to see what risk these shocks pose to you, and how to plan for them.

[1] OECD Life expectancy at 65, 2024, https://data.oecd.org/healthstat/life-expectancy-at-65.htm

[2] American Academy of Actuaries and Society of Actuaries, Actuaries Longevity Illustrator, 2023, https://www.actuary.org/node/16495

[3] Munnell, Alicia. “A Major Risk Facing Older Americans: The Need for Long-Term Care – Center for Retirement Research.” Center for Retirement Research at Boston College, 18 Mar. 2024, crr.bc.edu/a-major-risk-facing-older-americans-the-need-for-long-term-care/.

[4] “Cost of Long-Term Care by State | Cost of Care Report.” Www.genworth.com, www.genworth.com/aging-and-you/finances/cost-of-care.

[5] Spiegel, Jake, and Paul Fronstin. “Projected Savings Medicare Beneficiaries Need for Health Expenses Increased Again in 2023.” Ebri.org, 18 Jan. 2024, www.ebri.org/publications/research-publications/issue-briefs/content/projected-savings-medicare-beneficiaries-need-for-health-expenses-increased-again-in-2023.

Collin Hartley,

Associate Wealth Planner