During his campaign newly elected president Donald Trump proposed a range of ambitious and significant economic policies, signaling a bold new direction for the US economy. Markets are mainly concerned about three key areas: Tariffs, Taxes and Deregulation. So, what can we expect to happen after January 20th?

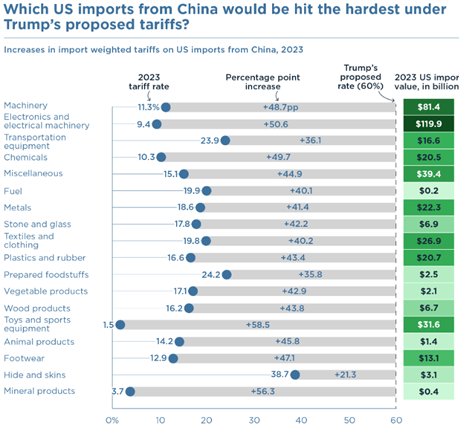

Tariffs are coming back. One of the most consequential changes is the new President’s desire to raise tariffs broadly, a sharp reversal from the previous one hundred years of tariffs coming down. He’s mentioned that he plans to implement a 60% tariff on China in addition to imposing 25% tariffs on goods from Canada and Mexico. The table gives us a sense of the impact from tariffs on goods imported from China. The biggest impact would be on electronics and machinery. A 60% tariff on those two categories alone would increase costs and tax revenue by approximately $100 billion, impacting everything from iPhones to refrigerators. The overwhelming majority of toys (74.6%) come from China and nearly half of all shoes (41%). The tariffs on China stand to drastically increase the amount corporations and consumers pay to source goods.

According to Bloomberg, retailers have been frontloading orders from China and finding alternative sources ahead of the increase. Goldman Sachs is expecting the tariffs on Chinese goods to be implemented immediately after inauguration. However, tariffs on other countries will take months to implement and may be reduced as trade negotiations proceed.

Economists are expecting tariffs to be moderately inflationary (CPI estimate of 3% vs 2.7% today). Consequently, we have seen interest rates rise recently with the 10-year treasury bond surging from 4.30% the day before election day to recently hit a high of 4.79%. Tariffs, a strong labor market and potential wage inflation due to deportations have contributed to bond traders being wary of an inflation resurgence causing the Fed to pause rate cuts or even raise rates.

The incoming President’s tax policies, particularly his pledge to extend the 2017 tax cuts (TCJA), are not expected to have an immediate impact. With Republicans narrowly controlling the House and Senate it is safe to assume most of the tax cuts will be extended, however other aspects of the cuts will be more difficult without some support from Democrats. The more controversial ones being the limit of $10,000 deduction on state and local taxes (SALT) and the estate tax. Increasing the SALT deduction to $30,000 would widen the budget deficit to $40 billion per year.

The campaign proposals to remove taxes on Social Security, tips and overtime would provide more tax cuts to middle class voters at the expense of widening the budget deficit by over $100 billion per year. As mentioned earlier, the narrow margins in the House and Senate make these proposals much less certain and will involve some horse trading.

Business taxes will also be impacted, with a proposed reduction to 15% for domestic manufacturers, the extension of 20% reduction for pass-through entities and bonus depreciation. President Trump will want to make the business tax cuts permanent instead of expiring at end of 2025 as currently scheduled.

Under President Trump there will likely be a significant push for deregulation, and the impact of this campaign promise might be the toughest to estimate. The most identifiable target for deregulation is environmental mandates, specifically targeting the EPA. Somewhat related would be scrapping the SEC rule requiring public companies to report on climate related risks of their operations. This form of deregulation has the potential to boost shares in fossil fuel companies.

The incoming administration also wants to rescind all unspent funds of the Inflation Reduction Act, affecting subsidies for a variety of green energy companies. On the campaign trail, Trump had stated a goal of removing ten regulations for each new one. In order to prevent new regulations, the legislature can use the Congressional Review Act to overturn regulatory rules proposed by different agencies. If both the House and Senate vote against a rule and the President signs it, the rule cannot go into effect. The new Administration can use this power to prevent new regulations from being enacted. The focus on deregulation will reduce compliance costs but without seeing the individual regulations targeted, it is difficult to project the economic impacts.

In a similar vein President Elect Donald Trump has created a committee known as the Department of Government Efficiency (DOGE). Headed by Elon Musk and Vivek Ramaswamy DOGE has an aggressive goal of cutting $2 trillion in government spending. The easy low hanging fruit could be Bidens executive actions totaling $100 billion in spending and it will not require congressional approval. We will have to wait to see where the rest of the cuts come from until July 4, 2026, when DOGE finishes its inquiry. Most budget experts on not optimistic they will find anything close to their targeted amount without cuts to Social Security and Medicaid/Medicare. Even Musk has recently walked back his expectations. All these proposed policy changes are set to take place against a backdrop of a robust economy as we enter 2025. Unemployment is a low 4.1%, GDP growth is 2.7% as of Q3 2024, and inflation is heading back toward the Fed’s target (currently at 2.9%). This led the S&P 500 to a 23% return last year, surprising even the most optimistic forecasts. However, in response to the new Administration’s policies the Fed has dialed back rate cut expectations for 2025 and is taking a wait and see approach for clarity, and to ensure the deflation trend continues. Markets hate uncertainty and unfortunately, we have plenty of it right now. While markets have been well behaved, we expect things to get a bit more bumpy from here.

Andrew Otten,

Associate Portfolio Manager