As the summer winds down, we approach what many of us in Michigan call “the dog days of summer.” A time to bask in the warm sunshine, reflect on the summer activities and start planning for the fall and winter seasons ahead. For some, it’s also a time to assess their personal financial situation – specifically, their retirement planning.

For most people, a career can span 40 to 50 years. During that time, you share experiences with many different colleagues and evolve professionally and personally as the workplace and technology changes around you. However, one element that remains constant is the need to plan for your financial future. Whether you are 25 and have recently graduated or 60 years young and visualizing what the next chapter looks like, saving for retirement is extremely important. Pondering the future can be difficult for some but if you simply address a couple of key steps you can put yourself in a position for success.

Evaluate Your Finances:

One of the most important things to do is to periodically evaluate your overall financial situation. At times, it can feel like our lives are constantly consumed with something more pressing, whether it be getting married, starting a family, buying a car or a home, or simply balancing life’s demands. Despite these events you should always carve out time to evaluate where you are financially even if it is just an annual review of your portfolio. This review can help you develop and stick to a sound budget or re-evaluate your current one. Doing this will force you to identify the strengths and weaknesses of your situation and will help you shape the way you spend and save going forward.

Save, Save, Save:

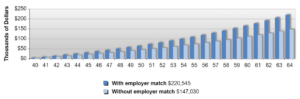

Perhaps the most crucial step to achieving that coveted retirement nest egg is saving. The earlier you can start saving the better off you will be. Contributing to an employer provided retirement plan is one of the easiest ways to do this. Best of all, many employers offer a matching program to help incentivize workers to enroll in their IRA or 401K programs. Think of it as free money and who doesn’t like that! The key is to start saving early. If you need specific details on how valuable starting early can be simply look at the two scenarios below.

Scenario #1: The Early Saver

Annual Salary: $50,000

Current Age: 25

Retirement Age: 65

Percent to Contribute: 6%

Employer Match: 3%

Annual Rate of Return: 5%

Scenario #2: The Late Bloomer

Annual Salary: $50,000

Current Age: 40

Retirement Age: 65

Percent to Contribute: 6%

Employer Match: 3%

Annual Rate of Return: 5%

As you can see, being in the market over a longer period of time can have a huge impact on your total savings, especially if your employer offers a matching program. These examples do not take into consideration salary increases over time, higher contributions to your retirement plan or higher growth rates; all of which are real possibilities over a 40-year timespan.

One of the best ways to get on the right track for retirement is by seeking advice from a financial planner. They can be an excellent resource in helping you lay the groundwork for a great retirement plan and can be very helpful when you conduct your periodic reviews. A financial planner can help you optimize your budget, allocate your investment account and tailor a strategy to meet your unique goals and objectives. During your periodic reviews you can also incorporate planning for other life events such as: purchasing a home, paying for college education expenses or even travelling the world in your golden years. These considerations should be a part of your overall wealth management strategy. The bottom line is when it comes to thinking about retirement, the more you have planned for it, the more enjoyable the “dog days” will be for you and your family.