1. On Wednesday March 16th, the Fed announced its long-expected rate liftoff, hiking by the expected 25bp and lifting the Fed Funds Target Rate lower bound off zero for the first time since early 2020.

After the meeting, the updated Summary of Economic Projections saw the dot plot move higher, with 2022 now showing a median of seven quarter-point hikes. Fed Chair Powell said the approach to raising rates would be “careful” initially but could turn more aggressive should inflation persist. Overall, investor takeaways from the meeting leaned hawkish despite heightened uncertainty caused by the ongoing conflict between Russia and Ukraine.

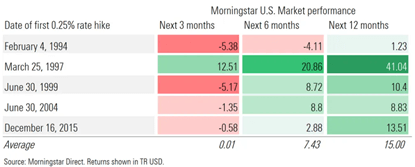

2. History shows that when the Fed starts raising rates, stocks often rally.

As the March FOMC meeting drew closer, growth companies that were trading at higher valuations moved sharply lower. But history shows that after the first hike is in, domestic equities prove resilient over the next 6 – 12 months. Looking at the five most recent rate hike cycles, U.S. markets, on average, were unchanged over a 3-month period, but averaged significant gains when measured on a 6 and 12-month basis.

Since Wednesday’s announcement at 2PM, the S&P 500 has rallied 4.7%, paring year-to-date losses to just -5.4 as of March 24. Conversely, fixed income investments have continued to struggle, with the Bloomberg US Aggregate now -5.8% year-to-date as the yield curve has flattened considerably. It’s early, with just a handful of trading days since the FOMC meeting, but if history holds true, equity markets could see significant appreciation over the next 12 months.

https://www.morningstar.com/articles/1084068/what-a-fed-rate-liftoff-means-for-stocks

Greg Barshied, CFA

Associate Portfolio Manager