In the ever-evolving landscape of cryptocurrency, few assets capture the attention and imagination quite like Bitcoin. From its humble beginnings in 2009 to its status as a global phenomenon, Bitcoin continues to make headlines with its price fluctuations, technological advancements, and regulatory developments. As we navigate the twists and turns of the Bitcoin rollercoaster, let’s take a moment to examine some of the recent events shaping the future of Bitcoin.

Bitcoin Halving:

Bitcoin recently celebrated its fourth “halving” event. The halving is when the Bitcoin algorithm cuts the mining reward in half, in this instance going from 6.25 Bitcoin received for every block added to 3.125. This reduction further adds to the scarcity of Bitcoin and historically has been followed by substantial price increases. It is too early to tell what will happen with this latest occurrence, but the halving is a major event for cryptocurrency. The reduction in Bitcoin received for miners will have a direct impact on the mining industry as costs remain the same but the benefit has been cut. This could lead to consolidation within the industry, especially if the price of Bitcoin does not react positively.

The Rise of Bitcoin ETFs:

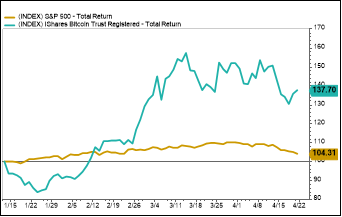

One of the most significant developments in the world of Bitcoin is the emergence of Bitcoin exchange-traded funds (ETFs). These investment vehicles have allowed investors to gain exposure to Bitcoin without actually owning the underlying asset. In recent months, the approval of Bitcoin ETFs on several major exchanges such as the NYSE, Nasdaq and CBOE Global Markets has sparked renewed interest in cryptocurrency among institutional and retail investors alike. With the potential to bring billions of dollars into the Bitcoin market, ETFs represent a major step towards mainstream adoption. Below is a chart of one of the largest Bitcoin ETFs, iShares Bitcoin Trust (IBIT). You will notice that since the inception of the fund on January 5th of this year, Bitcoin has done very well. The reason for this performance has likely been driven by a variety of factors but one of the top seems to be institutional adoption and access to these better known vehicles. As of this writing, the net assets of the fund was $17B, just over three months from the inception of the fund.

Regulatory Scrutiny:

However, along with the excitement surrounding Bitcoin ETFs comes increased regulatory scrutiny. Governments around the world are struggling with how to regulate Bitcoin and other cryptocurrencies, balancing the need for consumer protection with the desire to foster innovation. Recent regulatory developments, such as China’s crackdown on Bitcoin mining and trading, highlight the challenges facing the cryptocurrency industry. As policymakers continue to debate the future of digital assets, uncertainty remains a constant factor in the world of Bitcoin.

Volatility:

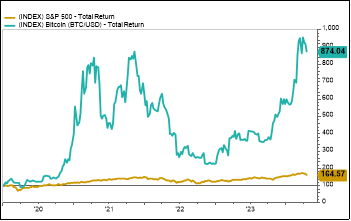

As we have seen from Bitcoin’s history, the cryptocurrency is not for the faint of heart. Since the inception of Bitcoin in 2009, BTC has seen phenomenal growth and also experienced tremendous volatility. Any early investors have surely been rewarded but it has taken a strong stomach at times. Below is a chart that reflects the change in value of Bitcoin since 2020. While Bitcoin has gone up substantially, you will notice the price chart looks a lot like a roller coaster. It goes without saying that if you are going to fold Bitcoin into your portfolio, you should do so knowing that it will be a volatile asset class.

The Carbon Footprint Debate:

Another issue garnering attention in the Bitcoin community is its environmental impact. Bitcoin mining, the process by which new bitcoins are created and transactions are verified, requires vast amounts of energy. Critics argue that Bitcoin’s carbon footprint is unsustainable and contributes to climate change. In response, some Bitcoin advocates are exploring alternative mining methods, such as renewable energy sources, to reduce the cryptocurrency’s environmental impact. The debate over Bitcoin’s carbon footprint underscores the broader conversation about sustainability in the digital age.

In summary, with the recent institutional adoption and strong in flows, it’s clear that Bitcoin is here to stay and likely to gain traction with more investors. That being said, the cryptocurrency space continues to be highly volatile and is still grappling with regulatory risks along with security concerns. If you are thinking of making an investment in Bitcoin or any other cryptocurrency, do so knowing that the asset class will surely have ups and downs and past performance is not indicative of future results.

Brain Balke

Senior Portfolio Manager & Wealth Advisor