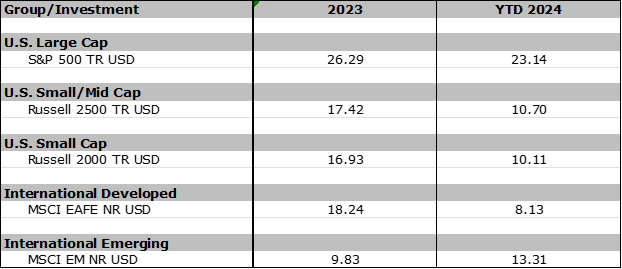

October 31st is near and here at Legacy Trust headquarters we take Spooky Season very seriously. While advisors and clients alike have enjoyed the ‘treats’ of strong equity market returns in both calendar year 2023 and year-to-date 2024, a word of caution about ‘tricks’ that may be looming.

Data through market close 10/25/2024

We acknowledge that investors and markets are constantly facing frightening or even ghoulish conditions leaving even the bravest participants uncertain of what lurks ahead. Just as trick-or-treaters weigh the risks of visiting dark houses at the end of a long, winding driveway, so too must investors consider the balance of risks and rewards of returns going forward.

Below, take a look at some (not all!) of the scary things that could cause a witches’ brew of volatility in the remaining months of 2024 and into the new year. From there, we’ll assign a rating from 1 to 5 pumpkins, indicating just how frightening each category is.

- Creeping Inflation – 🎃🎃🎃

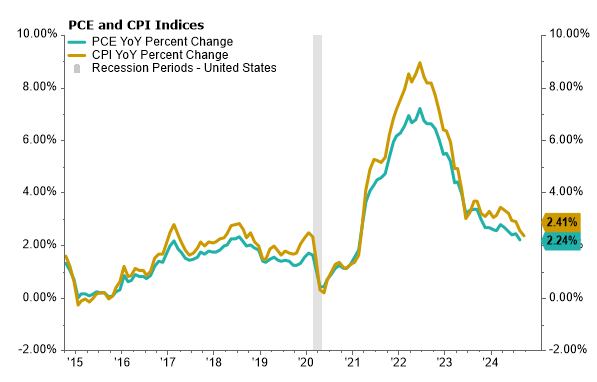

While significant progress has been made bringing inflation back towards the Fed’s stated goal of 2.0%, inflation will remain top of mind for investors even as it trends lower. Inflation remains top of mind because of its direct relationship with Fed policy.

Several categories of CPI have remained stubbornly sticky, even as other categories have normalized and, in some cases, turned negative year-over-year. The September 2024 CPI report showed a +2.4% increase year-over-year, the smallest increase since February 2021. Still, shelter remains an issue- prices increased +4.9% year-over-year, accounting for over 65% of the headline number for CPI ex-Food and energy. Other categories driving the CPI higher include food away from home and motor vehicle insurance.

Even with continued progress on the inflation front, a number of things can cause a reacceleration that would be disruptive to the Fed’s intention to ease rates over the next 18 months. Supply chain disruptions, volatile energy prices, a demand shock from consumers, tightness in the labor market, and more can re-ignite inflationary concerns and cause panic in markets.

Investors will get four additional inflation datapoints before year end- CPI on November 13th and December 11th, as well as PPI on November 14th and December 12th.

2. Ghosts of Past Returns – 🎃🎃🎃

The S&P 500 has enjoyed a tremendous 5-year run, returning +15.79% annualized compared to the 20-year annualized return of +10.85%. As returns have outpaced corporate earnings growth, valuations have pushed higher.

The S&P 500’s Forward 12-months Price/Earnings multiple is currently 21.7x compared to the 5-year average of 19.6x and 10-year average of 18.1x. History shows that a high beginning valuation is predictive of lower returns going forward.

A 21.7x forward multiple is a few turns rich compared to historical averages, meaning that long-term returns must come primarily from earnings growth, rather than further multiple expansion. If forward returns come from multiple expansion, given the already elevated levels, equities will appear overvalued to investors and the marginal dollar will be invested elsewhere.

3. The Fortune Teller’s Glimpse: Election 2024 – 🎃

November 5th is fast approaching, and uncertainty remains in competitive races for president and control of Congress. Prediction markets (Predicit, Kalshi, Polymarket) have Trump as the favorite, while polls mostly call the race too close to call and well within the margin of error.

The election receives just 1 pumpkin on our scale because historically, stock market performance doesn’t show a direct link between election years and market outcomes. In reality, the underlying economic and earnings environment should continue to take precedence, regardless of outcome. Any volatility from an election is likely to appear in the short-run and tends to buff out over time for long-term investors.

If one party ultimately controls both the White House and Congress, we’d upgrade the risk to 2 pumpkins. A sweep would give the controlling party an easier path to policy reform and there could be meaningful knock-on effects including, but not limited to: government spending and the already ballooning national debt, changes in taxation at the corporate and individual level, immigration as it relates to the labor market, and tariffs/global trade.

4. Eerie Concentration at the Top – 🎃🎃🎃

Market concentration of the top 10 largest S&P 500 stocks is at its highest since the dot-com era. With the Magnificent 7 alone representing 32% of the S&P 500 cap-weighted index (AAPL 7.2%, NVDA 7.1%, MSFT 6.5%, GOOGL 3.7%, AMZN 3.6%, META 2.6%, TSLA 1.5%), there is a lot of risk tied to a handful of companies. Fortunately, the market caps of the Magnificent 7 are underpinned by strong fundamentals including earnings, margins, and return on equity, compared to the dot-com era when much of the valuation was tied to the expectation for high earnings growth and margin expansion.

Still, some of the largest companies currently trade at premium multiples indicating investor expectations that they will maintain the high sales growth and profit margin expansion at similar rates that they have previously, while year-over-year comparisons become increasingly harder after a decade of prolific growth. On a Forward 12-months Price/Earnings basis, AAPL trades at 32.2x, NVDA 42.1x, MSFT 32.9x, GOOGL 20.9x, AMZN 36.6x, TSLA 82.6x. Signs of slowing growth in these names should be reason for multiple contraction and be problematic for passive investors.

5. Geopolitical Goblins – 🎃🎃

Geopolitical unrest has been a years ongoing headwind, with a multitude of conflicts contributing to instability across much of the globe. Despite the impact on U.S. markets remaining relatively muted, the risks posed on global economic growth should not be ignored.

The countless ongoing conflicts pose risks to global supply chains and can cause unexpected bouts of inflation (Russia-Ukraine and European energy disruptions, for example).

Wishing you a Happy Halloween!

Greg Barshied,

Portfolio Manager